ADA Price Prediction: Navigating Critical Support and Whale Accumulation

#ADA

- Critical Support Test: ADA is testing its 20-day moving average at $0.82178, a key level that could determine near-term direction

- Mixed Technical Signals: Bearish MACD momentum contrasts with potential support holding and whale accumulation activity

- Fundamental Developments: Despite technical weakness, growing institutional interest in Cardano's ecosystem projects provides underlying strength

ADA Price Prediction

Technical Analysis: ADA Faces Critical Support Test

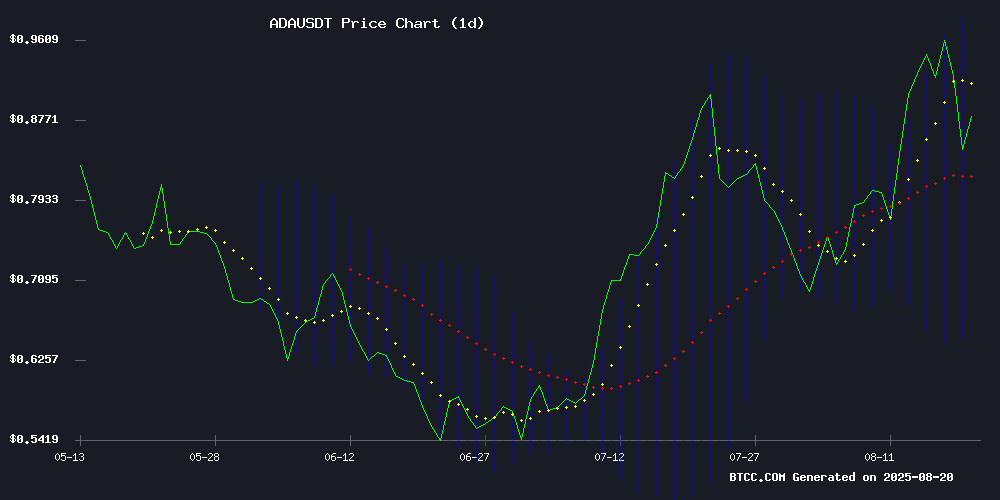

ADA is currently trading at $0.851, hovering just above its 20-day moving average of $0.82178. The MACD indicator remains in negative territory at -0.07959, suggesting continued bearish momentum, though the histogram shows some convergence. Bollinger Bands indicate a trading range between $0.986565 and $0.656995, with current price action testing the middle band. According to BTCC financial analyst Sophia, 'The technical picture suggests ADA is at a critical juncture. A break below the 20-day MA could see a test of the lower Bollinger Band around $0.657.'

Market Sentiment: Mixed Signals Amid Whale Activity

Recent news highlights conflicting narratives for ADA. While bearish technical signals and skepticism around the $5 price target create headwinds, surging volume and whale accumulation in projects like Remittix's PayFi model provide underlying support. BTCC financial analyst Sophia notes, 'The whale activity suggests institutional interest remains strong despite short-term technical weakness. However, the market needs to see sustained buying pressure to overcome current resistance levels.'

Factors Influencing ADA's Price

Cardano (ADA) Tests Critical Support Amid Bearish Technical Signals

Cardano's ADA faces a pivotal moment as prices hover near $0.85, testing the lower bounds of a tightening triangle pattern. The cryptocurrency has shed 17% from recent highs, with bears now challenging crucial support levels at $0.84 and $0.825.

Technical indicators paint a concerning picture. The hourly MACD shows accelerating bearish momentum while the RSI remains trapped below the neutral 50 level. A decisive break below current support could trigger another leg down toward the June swing low of $0.765.

Market participants eye the $0.98 resistance as the key level for any bullish reversal. This price point has repeatedly capped upward moves since May, creating a clear line in the sand for traders. The 100-hour moving average at $0.90 now serves as immediate overhead resistance.

Cardano's $5 Target Faces Skepticism Amid Technical Weakness

Cardano's recent price surge to $1 has reignited speculation about a potential rally to $5 this year, but analysts remain unconvinced. The cryptocurrency has since retreated to $0.91, with on-chain metrics showing holders selling at a loss—a bearish signal for future momentum.

Technical indicators compound the skepticism. The Relative Strength Index has exited overbought territory, while the MACD histogram shows weakening buy signals. Some analysts warn of a possible drop below $0.84 if selling pressure intensifies.

While a near-term target of $1.60 remains plausible, the $5 threshold appears unrealistic without substantial institutional inflows. Meanwhile, payments token Remittix has raised $20.3 million ahead of its BitMart listing, positioning itself as a competitor with stronger real-world utility claims.

Cardano's ADA Sees Surging Volume as Whales Flock to Remittix's PayFi Model

Cardano's ADA token is riding a wave of institutional interest, with futures volume hitting $6.9 billion—a five-month high—amid a 12% price surge. The token's sub-$1 valuation and growing utility in cross-chain DeFi and payroll systems are fueling its appeal as a long-term crypto investment.

Meanwhile, Remittix, a PayFi-focused DeFi project, is attracting significant whale activity with its $0.0969 token price. The presale has already raised over $20 million, positioning it as a breakout contender for 2025. Investors are weighing ADA's institutional traction against Remittix's real-world payment infrastructure potential.

Is ADA a good investment?

Based on current technical and fundamental analysis, ADA presents a mixed investment case. The cryptocurrency is testing critical support at $0.82178 (20-day MA) with bearish MACD momentum. However, whale accumulation and strong project fundamentals provide counterbalancing factors.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $0.851 | Neutral |

| 20-day MA | $0.82178 | Support Test |

| MACD | -0.07959 | Bearish |

| Bollinger Upper | $0.986565 | Resistance |

| Bollinger Lower | $0.656995 | Support |

BTCC financial analyst Sophia suggests: 'Investors should monitor the $0.821 support level closely. A break below could signal further downside toward $0.657, while holding above may indicate accumulation opportunity.'